Education Loan For Studying Abroad!

- 5000+ Eligible Universities

- 5000+ Eligible Universities

- ₹50 Lakhs Worth Scholarship

- 100% financing upto ₹3 Cr

- 20+ Banking Partners

- Loan Approval in 48 Hrs*

80 Cr+

Disbursed

10K+

Loans Facilitated

20+

Countries

Over view

Studying abroad is more than earning a degree—it’s about gaining global exposure, industry-ready skills, and a competitive edge. But international education often comes with a high price tag.

That’s where we step in. Our overseas education loan solutions are designed to cover tuition, living expenses, travel, and more, so you can focus on your future without financial stress

For Indian students, navigating the loan process can feel overwhelming—endless paperwork, multiple bank visits, and complex requirements. With us, you’ll never face it alone.

We match you with the right education loan tailored to your course, budget, and repayment goals. From the first document to the final sanction, our experts guide you every step of the way, ensuring a smooth and hassle-free journey to your dream university.

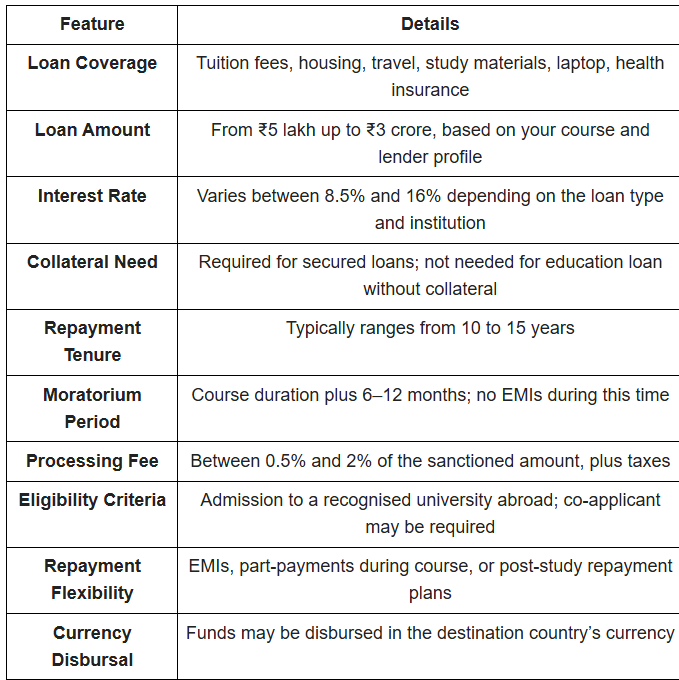

Key Features of a Study Abroad Education Loan

An international education is an investment in your future. A well-planned study abroad loan helps you cover major costs and focus on your academic goals.

Whether you apply for a secured or unsecured abroad education loan, most lenders offer coverage that extends beyond tuition fees.

From flights and accommodation to books and insurance, these loans are designed to ease your financial burden.

Types of Education Loans for Studying Abroad

When it comes to financing your overseas education, there are two main types of loans: secured and unsecured.

The key difference lies in whether or not you’re required to offer collateral. Both options are designed to support your academic goals, but each comes with its own conditions.

Secured Education Loan (With Collateral)

A secured education loan for abroad studies requires you to pledge an asset. This could be:

- Residential property

- Non-agricultural land

- Fixed deposits

- Government-approved insurance policies

Banks and financial institutions offer these loans after verifying the value and ownership of your collateral.

Key Features of Secured Loans:

- Lower interest rates compared to unsecured loans

- Higher loan amounts sanctioned

- Longer repayment period with flexible EMIs

- No repayment required during your course (moratorium period)

- Parental income has minimal impact on approval

Unsecured Education Loan (Without Collateral)

An unsecured student loan for study abroad does not require any property, deposit, or asset as security. These loans are ideal for students who may not have collateral to offer.

Key Features of Unsecured Loans:

No asset pledge required

Faster application process with fewer legal checks

Available through NBFCs and select private banks

Interest rates are usually higher

Shorter repayment window in most cases

Partial repayment may begin during the course period

Co-applicant income is often a key approval factorA non-collateral education loan for studying abroad is convenient, but approval depends heavily on your academic record, the country of study, the course, and the co-applicant’s financial profile.

Looking for ⚡ Faster and streamlined Process?

Stories of Student Achievement

“From admission to loan approval, they were with me at every step. Studying abroad felt impossible, but they made it achievable.”

My parents were worried about the financial burden of sending me overseas. The consultancy patiently explained loan options and reassured us with clear plans.

They helped me get admission in Australia and arranged a student loan that fit my budget. Honestly, they felt more like mentors than consultants.”